Bad Debts Recovered Journal Entry

Reasons for Bad Debt. Accounting for Bad Debt Recovery.

Journal Entry For Recovery Of Bad Debts Accountingcapital

An irrecoverable debt is a debt which is or is considered to be uncollectable.

. These Guides will get you started providing information on how to establish businesses and users set initial preferences and choose the functional modules and accounting method you will initially use. Since IAP has already incurred various expenses called the cost of goods sold Cost Of Goods Sold The Cost of Goods Sold COGS is the cumulative total of direct costs incurred for the goods or services sold including direct expenses like raw material direct. Pass Journal entry for purchase of goods by Amrit Delhi from Add Gel Pens Delhi for 15000 less Trade Discount 10 and Cash Discount 3 CGST and SGST is levied 6 each.

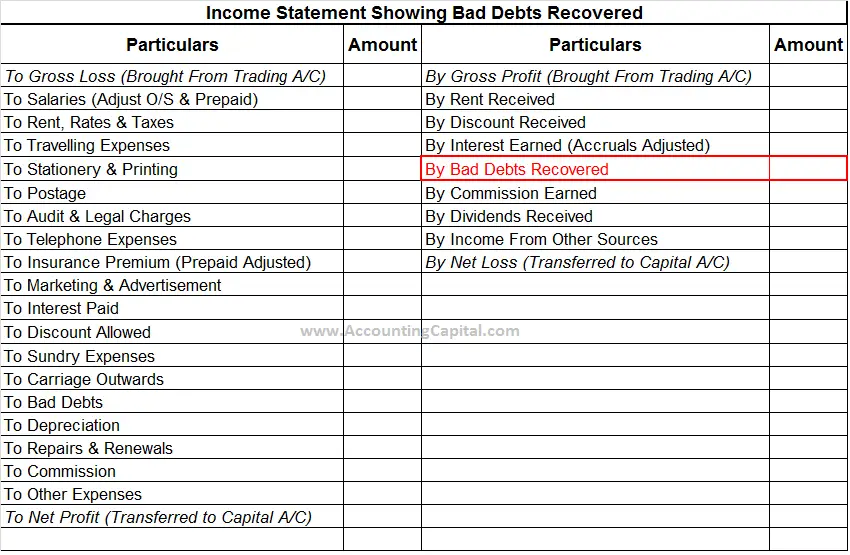

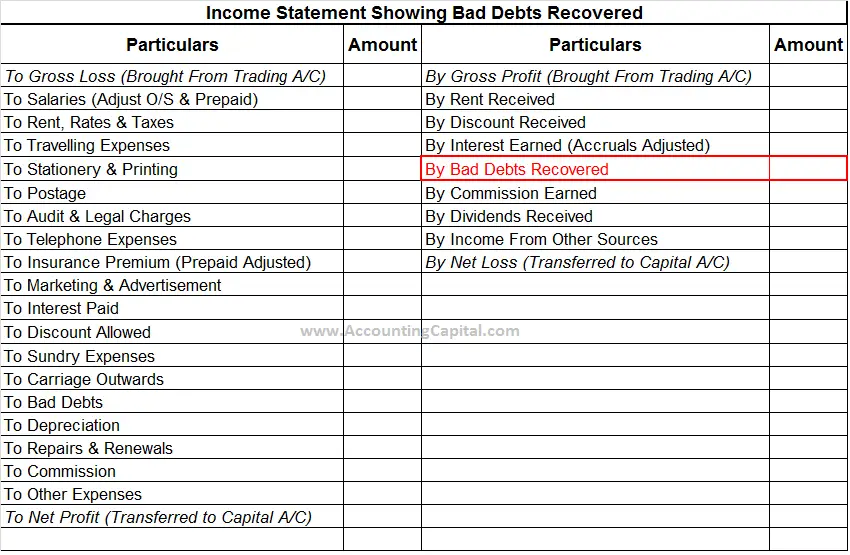

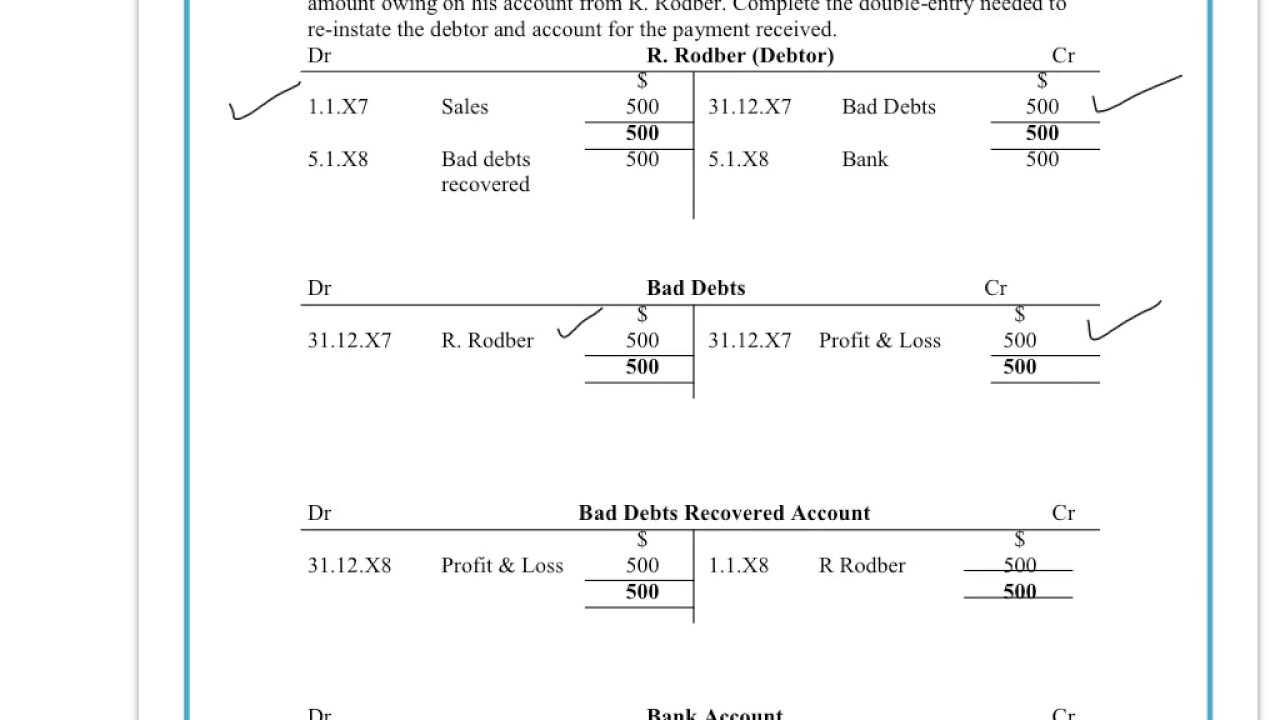

The entry is the transfer from the statement of profit or loss for the closing inventory of the previous year figures invented. If previously written off bad debts are recovered now it should not be recorded in the S L Control Account as bad debts recovered account appears in the general ledger but not in the sales ledger. To know the accounting for bad debts recovered it is necessary to know what bad debts are and how they arise.

The concerned debtors account is closed in the books of the firm and at the end of the period the bad debts account is transferred to the debit side of the Profit and Loss Account. This article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from him. There will be no entry for the promise made by Mohan since it is an event and not a transaction.

Provision for doubtful debts account is kept in the general. 3 Accounting for irrecoverable debts. Pass Journal entry for purchase of goods by Amrit Delhi from Ayur Products Agra UP for 25000 less Trade Discount 15 plus IGST 12.

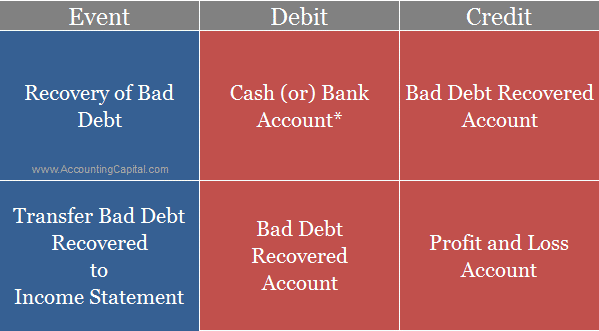

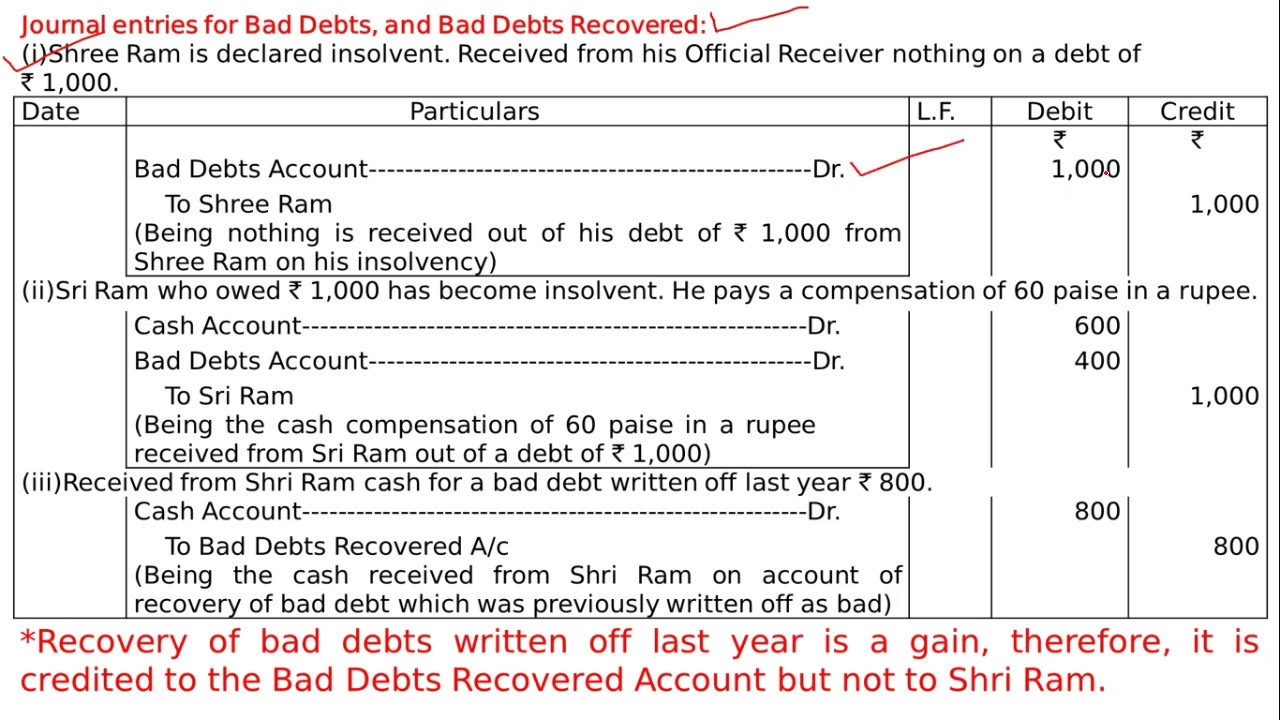

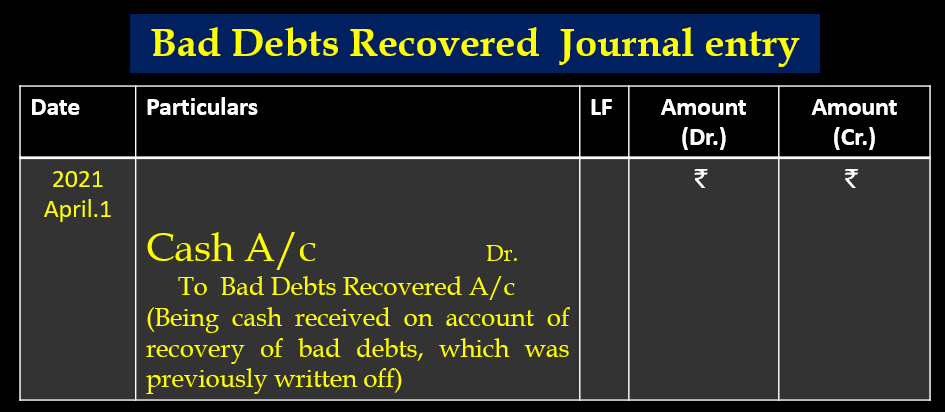

The accounting treatment of recovered amount requires two journal entries. Journal Entry for Recovery of Bad Debts. It must be transferred out to this years statement of profit or loss before the entry for the new closing inventory is made.

In the current year last years closing inventory is this years opening inventory. In this situation result. The trial balance helps detect any errors accurately.

Modern-day advances in accounting and Trial Balances. While posting the journal entry for recovery of bad debts it is important to note that it is treated as a gain to the business that the debtor should not be credited as in. Pass the necessary journal entries and Prepare Revaluation Account Partners Capital Accounts and opening Balance Sheet of the new firm.

Ledger implies the principal books of accounts wherein all accounts ie. Example 1 As on 01012012 Provision for Bad Debts Bad Debts Bad Debts can be described as unforeseen loss incurred by a business organization on account of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of any loan or other obligation. When a company supplies goods to a customer or another business on credit the company has to recognize the same amount of receivables in their books as to the value of sold items.

This then clears out the balance on the customerâs account. Journal ledger and Trial balance Financial Accounting CONTINUE 2. Eg The Indian Auto Parts IAP Ltd sold some truck parts to Mr.

Below are the examples of provisions for a bad debt journal entry. With such debts it is prudent to remove them from the accounts and to charge the amount as an expense for irrecoverable debts to the income statement. Read more is 5000.

The first entry is made to reinstate the. There is another view 3000 is to be considered as bad debts recovered. Personal real and nominal are maintainedAfter recording the transactions in the journal the transactions are classified and grouped as per their title and so all the transactions of similar.

But with business needs becoming more diverse financial statements are needed to be in alignment with business health and funding so that effective decisions can be made. Gains Outward returns recovered bad debts discount received credits to PL etc Sales. And the remaining portion which is not recovered from the debtors is called bad debt.

Increase or decrease in the provision for doubtful debts. It is known as recovery of uncollectible accounts or recovery of bad debts. At times a debtor whose account had earlier been written off by a creditor as a bad debt may decide to make a payment this is called the recovery of bad debts.

Debts usually turn out as bad because of. So if purchases had been 280500 during the. Enter the email address you signed up with and well email you a reset link.

Journal Entries for Accounting Receivable. Overview Example Journal Entries.

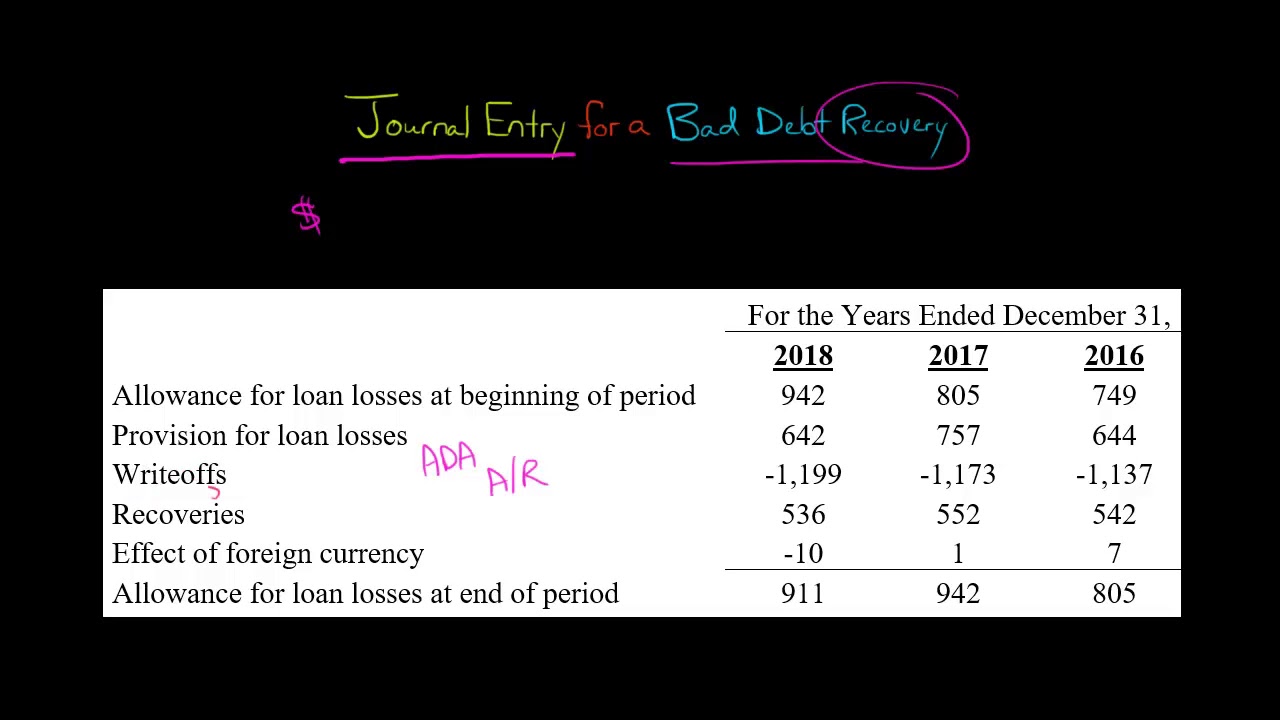

Bad Debt Recovery Allowance Method Double Entry Bookkeeping

Journal Entry For Recovery Of Bad Debts Accountingcapital

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

Journal Entry For A Bad Debt Recovery Youtube

Journal Entries For Bad Debts And Bad Debts Recovered Youtube

Comments

Post a Comment